Graham Holdings Company (GHC)

GHC Intrinsic value

GHC Intrinsic value overview

GHC Historical intrinsic value

GHC Relative value

GHC Valuation multiples overview

GHC vs Peer Set Valuation Multiples Dynamics

GHC DCF sensitivity

GHC Discount rate (WACC)

Discover more GHC fundamentals

FAQ

What is the DCF value of Graham Holdings Company (GHC)?

As of today, DCF Value of Graham Holdings Company is $278.5, which is overvalued by 69.9%, compared to the current market share price of $926.0

How was the DCF Value calculated?

Step 1: Calculating Intrinsic Enterprise Value DCF Value was calculated by estimating Graham Holdings Company future free cash flow and then discounting it, using a chosen discount rate to determine Intrinsic Enterprise Value of $6.6B Step 2: Balance Sheet Adjustments Intrinsic Equity Value is calculated by subtracting Balance Sheet items (Cash & Equivalents, Short-term investments and Total Debt) from previously calculated Intrinsic Enterprise Value. This Intrinsic Equity Value is then divided by the total number of outstanding shares of 4,352,000 to determine DCF Value of $278.5

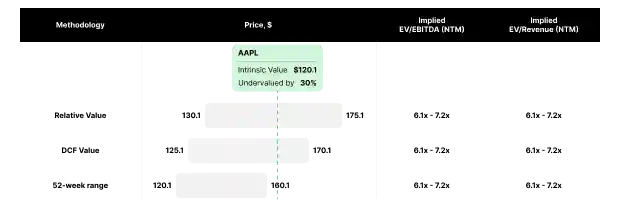

What is the Relative value of Graham Holdings Company (GHC)?

As of today, Relative Value of Graham Holdings Company is $804.1, which is overvalued by 13.2%, compared to the current market share price of $926.0

How was the Relative Value calculated?

Relative Value was calculated by applying various valuation multiples (EV/Revenue, EV/EBITDA, P/E etc.) to Graham Holdings Company financials to determine Relative Value of $804.1

What is Graham Holdings Company (GHC) discount rate?

Graham Holdings Company current Cost of Equity is 10.1%, while its WACC stands at 8.1%. Cost of Equity is used to value equity, while discounting free cash flow to equity holders (such as Net Income or Free Cash Flow to Equity). Weighted Average Cost of Capital (WACC) is used to value the entire firm, while discounting cash flows available to both debt and equity holders (NOPAT or Free Cash Flow to the Firm)

How is Cost of Equity for Graham Holdings Company (GHC) calculated?

The Cost of Equity represents the return a company must offer investors to compensate for the risk of investing in its stock. It's calculated using the Capital Asset Pricing Model (CAPM), which combines the risk-free rate, the stock's beta, and the equity risk premium (ERP). This model considers the inherent risk of investing in the stock compared to a risk-free investment and the market's overall risk. Cost of Equity = Risk-Free Rate + Beta x Effective Risk Premium (ERP) 10.1% = 4.51% + 1.1 x 5.0%

How is WACC for Graham Holdings Company (GHC) calculated?

WACC, or Weighted Average Cost of Capital, is a calculation that reflects the average rate of return a company is expected to pay its security holders to finance its assets. It is a critical measure in financial analysis for valuing a company’s entire operations. The WACC formula combines the costs of equity and debt, weighted by their respective proportions in the company's capital structure. WACC = Cost of Equity x Equity Weight in Total Capital + Cost of Debt x (1 - Effective Tax Rate) Debt Weight in Total Capital 8.1% = 10.1% x 77.2% + 6.6% x (1 - 78.7%) x 22.8%